Your Guide to a Perfect Rent Receipt Template

Create a professional rent receipt template with our practical guide. Learn what to include, how to customize it, and best practices for landlords and tenants.

A professional rent receipt is so much more than a simple slip of paper. Think of it as undeniable proof of payment—a crucial document that protects both landlords and tenants from headaches and disputes down the road. It's the official record for financial tracking, a piece of legal evidence, and a lifesaver for tax purposes.

Why a Professional Rent Receipt Is a Must-Have

It's tempting to see issuing a rent receipt as just another chore, but it’s really the cornerstone of a solid landlord-tenant relationship. This simple document carries a surprising amount of weight, turning a quick digital transfer or cash payment into a concrete, verifiable record. That small piece of paper (or its digital equivalent) builds a foundation of trust and transparency right from the start.

In our world of digital payments, it’s easy to think a bank statement is good enough. The problem is, a bank statement lacks context. It doesn't clarify which month the payment is for, or if it covers prorated rent or a late fee. A dedicated rent receipt spells everything out, leaving no room for misunderstandings.

This kind of professional documentation is invaluable in real-world situations that pop up more often than you'd think.

Averting Costly Payment Disputes

Let's say a tenant pays their rent in cash. Without a receipt, there's no official proof the transaction ever happened. If a disagreement comes up later, you're stuck in a stressful "he said, she said" scenario. A signed rent receipt stops this dead in its tracks. It provides clear, dated proof that the payment was made and accepted.

This one document can prevent arguments, protect security deposits, and keep the relationship civil. The data backs this up. Across the 44 million+ renter households in the United States, receipts are a vital tool. Shockingly, some studies suggest that as many as 78% of landlord-tenant disputes are tied to payment issues—a number that plummets when clear receipts are used consistently. For more on this, Jotform.com has some interesting insights into rental documentation.

The Power of a Professional Image

As a landlord, using a consistent, professional rent receipt template does more than just help you track income. It shows you’re organized and you take your role seriously. A well-designed receipt sends a clear message: you're a diligent property manager who values clear communication and proper record-keeping.

This professionalism often encourages tenants to treat their own obligations with the same respect. It subtly reinforces the formal nature of your lease agreement and sets a positive, business-like tone for all your interactions.

A rent receipt is the financial handshake of the rental world. It confirms the transaction, solidifies trust, and provides a clear record that protects everyone involved, turning ambiguity into certainty.

A clean, organized layout with clear fields, like what you can create with a tool like Receipt Maker, ensures all the essential information is captured, leaving no room for error.

Simplifying Tax Season for Everyone

When tax season rolls around, both landlords and tenants will be thankful for that neat stack of rent receipts.

- For Landlords: You have to report rental income accurately. Receipts give you an organized, chronological record of every payment received, making it a breeze to calculate your gross income and prepare your tax filings. This documentation is your best defense if you ever face an audit.

- For Tenants: Depending on where they live, tenants might be able to claim tax credits or deductions for the rent they've paid. A formal rent receipt is the official proof they need to claim these benefits, which could save them hundreds of dollars.

Without these records, tax prep can turn into a frantic search through old bank statements and emails. For more tips on this, check out our guide on how to organize receipts for taxes. A simple, consistent receipting process turns a potential nightmare into a straightforward task.

What Makes a Great Rent Receipt? A Field-by-Field Breakdown

A solid rent receipt isn't just some generic form you download—it’s a carefully crafted document that leaves zero room for misinterpretation. Think of it as the DNA of your payment record. Each component has a specific job to do, and together they create clear, legally sound proof that rent was paid.

Let’s break down the anatomy of a perfect receipt. We’ll separate the absolute must-haves from the smart additions that take your record-keeping from good to great. This isn't just about filling in boxes; it's about understanding why each piece of information is critical for protecting both you and your tenant.

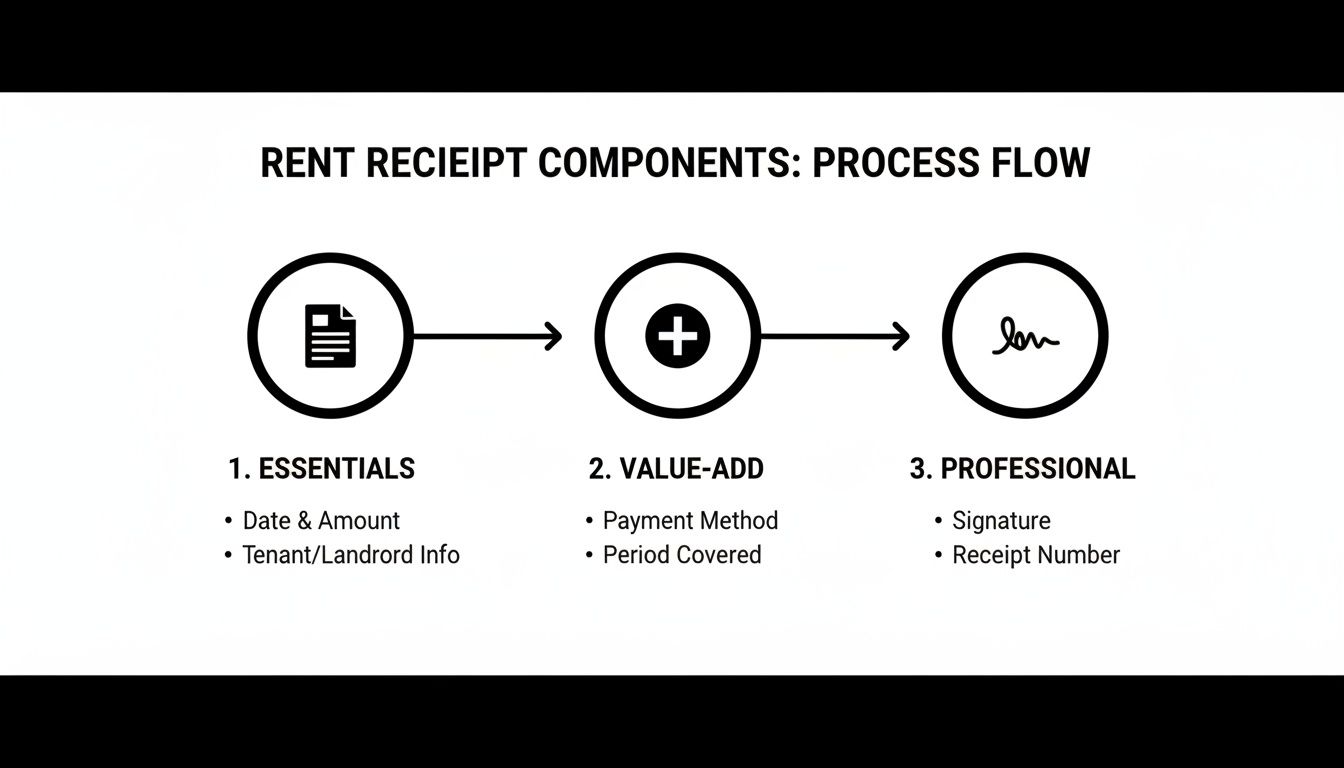

The Non-Negotiable Core Elements

Every single rent receipt you issue has to include these foundational fields. Without them, the document loses its punch and might not even hold up as a valid record. Treat this as your non-negotiable checklist for every single payment you collect.

Full Legal Names: Don't use nicknames or initials. You need the full legal names of both the landlord and the tenant, exactly as they appear on the lease. This is what officially ties the receipt to the rental contract.

Complete Property Address: Be painfully specific here. Include the street address, unit number (if there is one), city, state, and zip code. This prevents any mix-ups, which is especially important if you manage multiple properties.

The Exact Amount Paid: State the precise dollar amount you received. An old-school but effective trick is to write it out both numerically (e.g., $1,250.00) and in words ("One thousand two hundred fifty dollars"). This adds a layer of clarity and makes the amount much harder to alter.

Date of Payment: This is the date the money was actually in your hand or your bank account—not the date the check was written or the day rent was due. This timestamp is your proof for tracking on-time payments and dealing with any late-fee disputes.

The Rental Period It Covers: This is where a lot of disputes happen. Never just write "May Rent." Instead, be explicit: "May 1, 2024 - May 31, 2024." This clarity is absolutely vital if a tenant is paying late, catching up on a past month, or only covering a partial period.

Value-Add Fields for Airtight Records

Once you’ve got the essentials nailed down, you can add a few more fields to bring deeper context and professionalism to your receipts. These details answer follow-up questions before they’re even asked, making your bookkeeping airtight and minimizing the chance of future misunderstandings.

Think of these as the upgrades that turn a simple note into a comprehensive financial document.

A well-structured rent receipt does more than just confirm a payment; it tells a complete financial story. Including details like payment method and a running balance provides a clear, transparent narrative that builds tenant trust and simplifies your own bookkeeping.

Here’s what to include for that next level of detail:

A Unique Receipt Number: Assigning a sequential number to each receipt (e.g., #001, #002, #003) is a game-changer for organization. It makes pulling up a specific transaction during tax season or a dispute incredibly simple.

Payment Method: Did they pay with cash, check, a bank transfer, or a digital app like Zelle? Noting the method is crucial, especially for cash payments where the receipt is the only proof. For checks, adding the check number provides another layer of traceability.

An Itemized Breakdown of Charges: If the payment covers more than just the base rent, break it down. For example:

- Monthly Rent: $1,200

- Pet Fee: $25

- Parking Fee: $50

- Total Received: $1,275

This kind of detail is also incredibly useful for other financial documents. To see how this works in other contexts, learn more about creating a detailed itemized receipt template in our comprehensive guide.

Remaining Balance (If Any): If a tenant makes a partial payment, you need to clearly state what’s still owed. A simple line like, "Remaining Balance Due: $300," keeps both of you on the same page and prevents small debts from snowballing.

Your Signature: A signature—whether you sign it by hand or use a digital one—is what makes the receipt official. It’s your formal acknowledgment that you received the funds, adding a final layer of authenticity to the document.

How to Create Your Custom Rent Receipt

Let’s move from theory to practice. It’s one thing to know what should be on a rent receipt, but actually creating one on the fly is where most landlords get stuck.

Picture this: your tenant, Sarah from apartment 3B, just paid this month's rent in cash. She's heading out the door to work and asks for a receipt right then and there. Fumbling around for a piece of paper and a pen not only looks unprofessional but also opens the door to mistakes. This is exactly why a good rent receipt template is a landlord's best friend.

Instead of a dry, numbered list, I'll walk you through a real-world workflow using a tool like Receipt Maker. The goal here isn't just to fill in some boxes. It's about understanding how each piece of information builds a professional, trustworthy document that saves you time and protects both you and your tenant.

Start with a Professional Foundation

Your first move is to pick a design that looks clean and official. A cluttered or amateurish template can make the whole document feel less legitimate. You're aiming for something that says "official business record," not "homemade spreadsheet."

A good template library will offer a range of professional layouts, from classic thermal prints to more modern invoice styles. This variety is key because it lets you choose a rent receipt template that fits your management style, whether you’re handling a single condo or an entire apartment building.

Nailing the Essential Details

Once you've chosen your template, it's time to plug in the core information. These are the non-negotiable details that give the receipt its legal weight and make it useful for your records.

For Sarah's cash payment, you’d quickly enter:

- Tenant's Full Name: Sarah Johnson

- Property Address: 123 Maple Street, Apt 3B, Anytown, USA 12345

- Payment Date: The exact date you received the cash

- Amount Paid: The total sum received, for example, $1,450.00

- Rental Period: "October 1, 2024 – October 31, 2024"

Getting these details right is crucial. They create a clear, undeniable link between the money, the tenant, the property, and the specific month, which heads off any potential disputes down the road.

Break Down the Charges

Now, let's add a layer of professionalism. What if Sarah's payment wasn't just for rent? Let's say it also covered utilities and her reserved parking spot. A truly professional receipt breaks this down.

Instead of a single line item for $1,450.00, you should itemize every charge.

Pro Tip: Always itemize. It provides total transparency for your tenant and makes your own bookkeeping a breeze. You’ll be able to easily track income from different streams (rent vs. fees) come tax time.

For our scenario with Sarah, the itemized list would look something like this:

- Monthly Rent: $1,350.00

- Utilities (Water/Sewer): $50.00

- Parking Space Fee: $50.00

This breakdown instantly shows how the total was calculated. It's a small detail that makes a huge difference in clarity and prevents future questions.

Finalize and Deliver the Receipt

With all the information entered, the last step is to generate the receipt and get it to your tenant. Digital tools have completely changed this game. Platforms like Receipt Maker, for example, now offer over 100 different designs to give your receipts an authentic, retail-like feel.

It's no surprise that industry surveys show 70% of property managers now use these tools for their automation capabilities. A no-signup platform is especially useful here, letting you instantly export a PNG or JPEG file. These are often optimized for the 80mm thermal printers used in 60% of small rental agencies, which can cut printing costs by as much as 50% compared to traditional methods.

With a few clicks, you can download a PDF and email it directly to Sarah before she’s even left the building. This immediate delivery shows you're efficient and gives her the digital record she needs. If you're looking for more options, our guide on finding a great free online receipt template can point you in the right direction.

By following this simple workflow, you’ve turned a routine task into a professional exchange, created a perfect financial record, and built a little more trust with your tenant—all in just a couple of minutes.

Taking Your Receipts from Basic to Branded

A standard rent receipt does its job—it proves a payment was made. But a professionally branded receipt does so much more. It’s a subtle but powerful tool that builds your reputation and reinforces trust with every single transaction. Think of it as the difference between a simple scribbled note and a formal letterhead; one just works, the other communicates that you're an organized, credible professional.

This shift in perception can genuinely improve your relationship with tenants. For an independent landlord, it helps you look more established. For a property management company, it standardizes your communication, ensuring every tenant interaction reflects your high-quality brand. And turning a generic rent receipt template into a branding asset is easier than you might think.

Add Your Logo and Essential Contact Info

The quickest and most effective branding move you can make is to add your logo. It’s the first thing a tenant sees, and it instantly makes the document uniquely yours. It’s the visual anchor for your business.

Beyond the logo, the header and footer are prime real estate. Don't just settle for the default fields. This is your chance to provide useful information that reinforces your professionalism and makes you easy to reach.

- In the Header: Make sure your business name, direct phone number, and a professional email address are clearly visible. This turns the receipt into a handy reference document for your tenants.

- In the Footer: Add your website address if you have one. You could also include a short, friendly closing message like, "Thank you for your timely payment!" This small personal touch goes a long way.

Consistent branding across all your documents tells tenants you run a tight ship, which is always reassuring.

Choose Fonts and Colors that Match Your Brand

Visual consistency isn't just about your logo. The fonts and colors you choose also play a big part in your professional identity. While the top priority is keeping the receipt clean and easy to read, a few smart stylistic choices can make a real impact.

Think about the feeling you want to convey. A clean, modern sans-serif font like Arial projects efficiency and clarity. A more traditional serif font, like Times New Roman, can communicate stability and formality. Just pick one that aligns with your property management style and stick with it.

My Two Cents: Your branding is an extension of your service. A polished, branded rent receipt doesn't just record a payment—it quietly communicates reliability, organization, and respect for the landlord-tenant relationship.

Tools like Receipt Maker make this simple, allowing you to upload your logo and tweak these elements in just a few clicks. This ensures that every rent receipt template you create is a consistent piece of your brand. It’s a small detail that, over time, helps build a strong professional image and foster greater tenant confidence.

Best Practices for Distributing and Storing Receipts

Creating a sharp, professional receipt is a great first step, but what you do with it after it’s made is what really counts. A receipt you can't find is just as useless as one you never made. That's why building a solid system for sending and saving your receipts is so crucial—it protects your business and keeps things clear and professional with your tenants.

Think of your receipt archive as your financial safety net. A good system means you can pull up any payment record in seconds, whether it's for tax season, a simple tenant question, or, in a worst-case scenario, a legal dispute. Without a process, you’re just digging through old emails and random folders, which wastes time and looks disorganized.

Choosing Your Delivery Method

First things first: how are you going to get the receipt into your tenant's hands? The best choice usually comes down to what's easiest and most secure for both of you. Each delivery method has its own perks and pitfalls.

Sending a digital receipt, usually as a PDF, is often the most straightforward option. It’s instant, saves paper, and automatically creates a digital trail. Most tenants prefer this since they can easily file it away. But for some tenants, especially those who pay in cash, a physical, printed copy can offer peace of mind.

Here’s a quick rundown to help you figure out what works best.

Digital vs Physical Receipt Delivery Methods

Deciding between sending a PDF via email or handing over a printed copy depends on your specific situation. This table breaks down the pros and cons of the most common methods to help you choose the right approach for you and your tenants.

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Email (PDF) | Instant delivery, easy for both parties to store digitally, creates a timestamped record. | Can get lost in a cluttered inbox or flagged as spam. | Tech-savvy tenants and landlords who want a quick, efficient paper trail. |

| Printed Copy | Provides a tangible, physical record that some people prefer, especially for cash payments. | Can be easily lost or damaged, requires physical storage space, and uses paper and ink. | Tenants who are less comfortable with digital documents or who pay in person. |

| Cloud Service | Securely shares the receipt in a central location (like Google Drive) accessible to both parties anytime. | Requires both landlord and tenant to be comfortable using a shared platform. | Landlords managing multiple properties who want a centralized, shared repository for all documents. |

Ultimately, whichever method you land on, the most important thing is to be consistent. Make it a habit to send the receipt the moment you confirm payment. This simple routine prevents payments from getting lost in the shuffle and shows your tenants that you're reliable.

Building a Bulletproof Storage System

Once you've sent the receipt, your job isn't done. You absolutely have to store your own copy securely. This is a non-negotiable part of good bookkeeping and legal protection. A messy filing system can quickly become a huge headache, but a simple, logical one can be a lifesaver.

A rent receipt isn't just for your tenant; it's a critical piece of your own business documentation. Your ability to instantly find a specific receipt from three years ago is what separates a professional operation from an amateur one.

I always recommend a simple, digital filing system. Physical copies are just too risky—they can get lost, damaged in a flood, or fade over time. Instead, create a main folder on your computer for all your rental records and organize it logically.

Here’s a structure I’ve found works incredibly well:

- Property Address (e.g., "123 Main Street")

- Tenant Name (e.g., "Johnson, Sarah")

- Year (e.g., "2024")

- Inside this folder, save each receipt with a consistent name, like "2024-10_Receipt_Johnson.pdf".

- Year (e.g., "2024")

- Tenant Name (e.g., "Johnson, Sarah")

This nested folder system is super intuitive and makes finding any rent receipt template or past payment a breeze. For an extra layer of security, make sure you back up that main folder to a reliable cloud storage service. This protects your records from a hard drive crash or other disasters, ensuring your vital documents are safe and accessible for years to come.

Got Questions About Rent Receipts? We’ve Got Answers.

Even with the best system, you're bound to run into questions about rent receipts. These little documents can bring up some tricky practical and legal issues, but knowing what to expect can save you a world of headaches down the road. I've heard just about every question in the book from landlords and tenants alike, so let's clear up a few of the most common ones.

Think of this as your field guide for those "what if" moments. From legal must-dos to tax season prep, let's dive in.

Is a Landlord Actually Required by Law to Give a Rent Receipt?

This is the big one, and the honest answer is: it depends entirely on where you live. There's no single federal law in the U.S. that says a landlord must provide a receipt. Instead, these rules are almost always decided at the state or even city level.

For example, states like New York, California, and Maryland have pretty clear laws on the books requiring landlords to issue a receipt, especially if a tenant pays in cash or simply asks for one. In other places, the law might not say anything at all.

Here's my take: regardless of what your local laws say, you should issue a receipt for every single payment. It’s just good business. It clears up any confusion, builds trust with your tenant, and gives both of you an essential paper trail if a dispute ever pops up.

Making this a habit is simple. A good rent receipt template turns what could be a chore (or a legal requirement) into a quick, professional part of your routine.

What if My Landlord Refuses to Give Me a Receipt?

Okay, so you've paid your rent and your landlord won't give you a receipt. Don't panic—you have a few ways to handle this and protect yourself. Your first move should always be to make a formal, written request. An email is great, but a certified letter is even better because it provides definitive proof that you asked.

If they still won't budge, it's time to do a little research into your local tenant rights. Most areas have tenant unions or legal aid services that can give you solid advice. If your landlord is breaking a local rule, that written request you sent becomes your star witness.

In the meantime, you need to create your own proof of payment:

- Pay with a Paper Trail: If you can, always pay with a personal check, cashier's check, or an online bank transfer. These methods automatically generate their own records of the transaction.

- Document Cash Payments: If you absolutely have to pay in cash, try to bring a witness with you who can sign a brief note confirming they saw you make the payment. Immediately after, send an email to your landlord saying something like, "Just confirming I paid you $1,200 in cash for October's rent today, October 1st."

Can I Use a Digital Rent Receipt for My Taxes?

Yes, one hundred percent. The IRS and other tax authorities are perfectly fine with digital records. In fact, they often prefer them. A digital receipt, like a PDF you create with a tool like Receipt Maker, is completely legitimate for tax purposes.

The key is making sure it has all the critical information we’ve already covered:

- The full names of both the landlord and tenant

- The property address

- The exact amount paid and the date of payment

- The specific month or rental period the payment covers

Honestly, digital receipts are a game-changer. They're so much easier to organize, find, and store than a shoebox full of paper. My advice? Keep a secure backup in a cloud service like Google Drive or Dropbox. You’ll thank yourself later.

How Long Should I Hang On to My Rent Receipts?

For both landlords and tenants, this is all about good record-keeping. The general rule of thumb is to keep all rent receipts for at least three years. This covers the IRS's typical window for looking back at your tax filings.

But if you want to be extra cautious—and I usually recommend it—holding onto them for up to seven years gives you an added layer of security. You never know when a longer-term financial audit or a legal issue might come out of the woodwork.

Storing them digitally makes this painless. You can create a simple folder system like "Property > Tenant Name > 2024 Receipts" and find any document you need in seconds. No clutter, no fuss.

Ready to create professional, branded receipts in seconds? With Receipt Maker, you can choose from over 100 templates, customize every detail, and generate a perfect receipt for every payment. Start for free and see how easy professional record-keeping can be at https://receiptmakr.com.