How to Create an Employee Expense Reimbursement Policy That Works

Build a clear and compliant employee expense reimbursement policy. Our guide covers everything from allowable expenses and tax rules to templates and tools.

An employee expense reimbursement policy is simply a formal document that lays out how your company pays back its team for business-related costs they've covered out-of-pocket. Think of it as a playbook. It sets clear rules for what expenses qualify, how employees should submit them for repayment, and when they can expect to get their money back. Having this framework in place is absolutely crucial for managing costs and making sure everyone is treated fairly and consistently.

Why a Clear Expense Policy Is a Business Essential

A good expense policy does so much more than just keep spending in check; it’s a critical piece of your company's operational backbone. Without one, you’re inviting a mess of inconsistency, budget leaks, and even potential legal headaches.

Just picture this: one manager happily approves a fancy team dinner, while another denies a similar, more modest request from a different team. That kind of ambiguity creates frustration and can seriously damage morale.

When the guidelines are foggy or just don't exist, your team is left guessing what’s okay to spend. This often leads to one of two outcomes: they either overspend on things that aren't really necessary, or they avoid spending on essential tools that could actually help them do their job better. Either way, it's not a good look. Plus, your finance team ends up wasting precious time questioning every receipt and chasing down paperwork, which is a huge administrative drag.

Protecting Your Business and Building Trust

A well-crafted policy really acts as a shield for your company. First off, it helps prevent expense fraud by clearly defining what counts as a legitimate business cost. It also ensures you stay compliant with tax regulations. For instance, the IRS has specific rules for an "accountable plan" that allows reimbursements to be non-taxable to employees. A solid policy is your best guide to meeting those requirements.

But it's not just about rules and regulations. A transparent process builds a culture of trust. When your team understands the rules and knows they’ll be repaid promptly and fairly, they feel respected and valued. This might seem like a small thing, but it has a big impact on their financial well-being, as they aren't stuck carrying company costs on their personal credit cards for weeks on end.

A strong employee expense reimbursement policy isn't about restricting people—it's about empowering them with clarity. It turns a potentially chaotic process into a predictable system that helps both your employees and your bottom line.

Legal and Compliance Obligations

Beyond just being good business practice, having a formal reimbursement policy is a legal must-have in some places. Several states, including California and Illinois, have laws on the books that require employers to reimburse staff for all necessary work-related expenses.

These laws can cover a surprising range of costs, from a portion of a remote worker's home internet bill to the mileage an employee drives for client visits.

Failing to comply can open you up to expensive lawsuits and penalties. For a small business where every dollar counts, those kinds of financial hits can be devastating. A formal policy shows you're doing your due diligence and gives you a consistent way to meet your legal obligations, no matter where your team is based. It’s a foundational piece of your company's financial and cultural health.

Laying the Foundation: The Core of Your Expense Policy

Let's be honest—nobody enjoys wading through dense corporate policies. That's why building a great employee expense reimbursement policy isn't about writing a legal document; it's about creating a practical guide that everyone can actually use. A strong policy is clear, fair, and anticipates questions before they’re even asked, saving everyone a headache.

Your first move is to define the policy's purpose and scope. This is your mission statement. Keep it simple and direct. For instance, you could state that the policy exists to ensure "timely and consistent reimbursement for legitimate business expenses incurred by all full-time and part-time employees."

This simple sentence does a lot of heavy lifting. It immediately establishes that the rules apply to everyone, from the CEO to the newest intern, which is crucial for building trust. By clearly stating who is covered (full-time, part-time, contractors), you get rid of any gray areas right from the start.

What’s In? Defining Reimbursable Expenses

Once the groundwork is laid, it's time to get into the specifics. What, exactly, can an employee get reimbursed for? Vague terms like "travel" and "meals" are invitations for confusion and inconsistent approvals. The key is to break these broad categories down into clear, specific line items.

Think about it from your employee's perspective. Under "Travel," you could spell out things like:

- Airfare: Economy or premium economy class for flights over four hours.

- Lodging: Standard hotel rooms, maybe with a specific nightly cap based on the city.

- Ground Transportation: Mid-size rental cars, rideshares, or public transit passes.

- Mileage: Reimbursement for using a personal car at the current IRS standard rate.

This level of detail doesn't just restrict spending; it empowers your team. They can make decisions confidently, knowing they're operating within the company's expectations. It also gives managers a clear framework for approvals, ensuring fairness across the board.

A great expense policy isn't a list of "no's." It's a roadmap for smart spending. When you clearly define what’s covered, you empower your team to act decisively without second-guessing every purchase.

Of course, clarity works both ways. You have to be just as specific about what the company won't pay for.

What’s Out? Clarifying Non-Reimbursable Items

This is where you can prevent a lot of awkward conversations down the road. Creating an explicit list of non-reimbursable expenses is one of the most proactive things you can do. There should be no surprises when an expense report gets kicked back.

Here are some common examples of costs that typically aren't covered:

- Personal items bought on a trip (like souvenirs, magazines, or a forgotten toothbrush).

- Upgrades to first-class seats or a fancy hotel suite.

- Childcare or pet-sitting costs.

- Speeding tickets, parking fines, or other violations.

- Alcohol, unless it's part of a client dinner that was approved beforehand.

- In-room movies, gym day passes, or other personal entertainment.

Being upfront about these exclusions sets clear expectations. It reinforces the idea that reimbursement is for expenses that are truly necessary for business. If you want to dig deeper into the financial controls behind this, our guide on what is expense management offers a great overview of the whole process.

Setting Realistic Limits and Per Diems

To keep your budget in check, your policy needs spending limits. But these can't just be random numbers pulled out of thin air. They need to be based on real-world data and logic.

A daily meal allowance (or per diem) in New York City is going to look very different from one in Omaha. Likewise, a hotel cap should reflect the actual market rates in the destination city. A one-size-fits-all approach is not only impractical but also unfair to your employees.

The data shows just how much these costs can fluctuate. A 2023 analysis from Concur found that airfare became the single most expensive item, hitting an average of $770 per transaction. At the same time, lodging costs shot up 21% to $140 per transaction. Most revealing? A generic "other" category swelled to account for 22% of all spending, a clear sign that policies without specific limits lead to higher costs and more administrative chaos. You can explore more insights from this expense analysis.

Using data like this helps you set limits that are fair to your team while still being fiscally responsible. A simple table is a fantastic way to make this information easy to digest.

Common Reimbursable vs. Non-Reimbursable Expenses

To make things crystal clear, a side-by-side comparison can be incredibly helpful for your team. Here’s a quick reference guide that you can adapt for your own policy.

| Expense Category | Generally Reimbursable (with examples) | Generally Non-Reimbursable (with examples) |

|---|---|---|

| Travel & Lodging | Economy airfare, standard hotel rooms, approved rental cars. | First-class upgrades, luxury suites, valet parking for personal convenience. |

| Meals | Meals with clients, meals while on overnight travel (within per diem). | Lavish dinners, alcohol (unless pre-approved), meals with local colleagues. |

| Software & Tools | Pre-approved software subscriptions, necessary professional memberships. | Personal software, premium versions without business justification. |

| Office Supplies | Items for a remote office, stationery, other necessary supplies. | High-end furniture, decorative items, non-essential gadgets. |

This kind of at-a-glance guide makes it easy for employees to quickly check if a purchase is likely to be approved, reducing guesswork and submission errors.

By breaking your policy down into these core building blocks—purpose, scope, what's in, what's out, and clear limits—you transform it from a rigid rulebook into a helpful, easy-to-follow guide. This structure not only makes your internal processes smoother but also helps build a culture of trust and accountability.

Designing a Smooth Reimbursement Workflow

Even the most perfect employee expense reimbursement policy will fall flat without a simple, reliable process to back it up. A confusing or slow workflow is a recipe for frustrated employees and administrative headaches for your finance team. The real goal is to design a system that’s clear, efficient, and predictable for everyone.

Think of the workflow as the practical application of your policy—it’s what turns the rules on the page into a smooth, repeatable journey. It covers everything from how an expense gets documented to the moment your employee gets paid back.

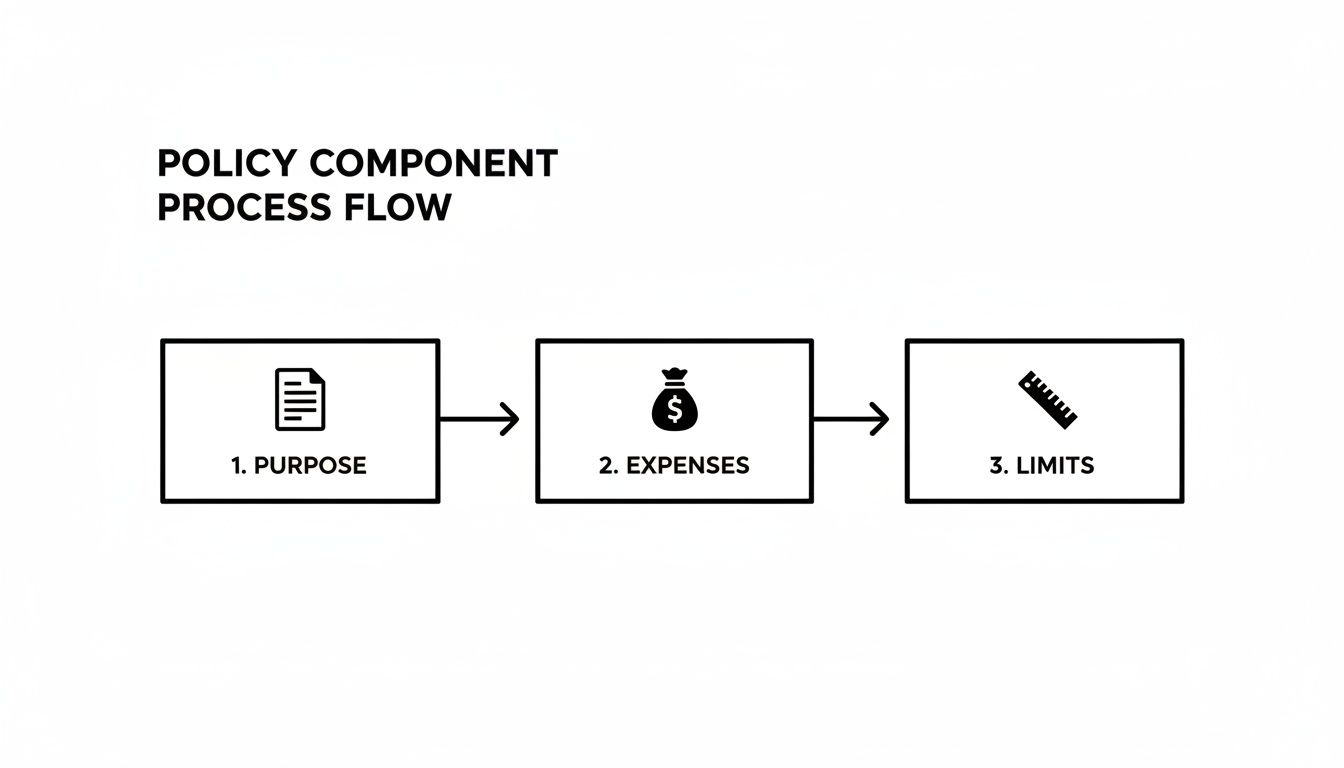

The diagram below breaks down the core components that anchor this workflow: the policy's purpose, what expenses are covered, and what the limits are.

This flow shows how a clear purpose and well-defined rules are the foundation. Now, let’s build the actual day-to-day process on top of that.

Documentation: The Non-Negotiable First Step

The entire reimbursement process lives or dies by one thing: proper documentation. The itemized receipt is the absolute cornerstone here, providing the necessary proof of a legitimate business expense. A credit card statement just won’t cut it; you need a detailed record of the transaction itself.

Your policy must be crystal clear about what makes a receipt valid:

- Vendor Name: Who was paid.

- Transaction Date: When the purchase happened.

- Itemized List of Goods or Services: What was actually purchased.

- Total Amount Paid: How much it cost.

- Proof of Payment: Something like the last four digits of the credit card used.

This level of detail is crucial for your internal audits and, more importantly, for satisfying IRS requirements under an accountable plan. Without it, you're looking at potential compliance issues and a ton of extra work for your finance team chasing down missing info. For more on this, our guide on how to track business expenses has some great tips for keeping records straight.

Creating a Clear Submission Process

Once an employee has the right documentation, they need a ridiculously straightforward way to submit it. A clunky, confusing submission portal is where most workflows completely break down. Your policy should outline this part of the process with absolute clarity, leaving zero room for guesswork.

Define your submission rules clearly. For example, state that all expenses for a given month must be submitted on a single expense report by the fifth business day of the following month. A firm deadline prevents reports from piling up and gives your finance team a regular, predictable cadence.

A well-defined submission process does more than just keep you organized—it sets a rhythm for your entire expense management cycle. Predictable deadlines lead to faster approvals and happier employees.

You also need to nail down the required format. Whether you’re using a simple spreadsheet template or dedicated expense software, provide clear instructions. Standardization makes it infinitely easier and faster for managers to review reports because they know exactly what they’re looking at and where to find the key details.

The Approval Chain: Preventing Bottlenecks

A common point of failure in any reimbursement policy is a tangled or slow approval chain. When a report sits in a manager's inbox for weeks, it delays payment and causes some serious frustration. A well-designed workflow maps out a clear, logical path for every single expense report.

Typically, the process should look something like this:

- Employee Submission: The employee puts together their report and submits it.

- Manager Review: Their direct manager gives it a once-over to confirm the expenses are legitimate and within policy.

- Finance Department Approval: The finance team does a final check for compliance, documentation accuracy, and budget codes before queuing it up for payment.

For bigger expenses, you might want to add another layer of approval, like a department head or an executive. Whatever your structure, document it so everyone knows their role in keeping things moving.

Setting Payment Timeline Expectations

The final, and most important, step for your employee is getting that money back into their pocket. Timeliness is everything here. Your policy should set a clear and realistic expectation for how long the payment process takes after a report gets its final approval.

A good standard to aim for is 5-10 business days post-approval. This is short enough to keep employees from floating business costs on their personal accounts for too long, but it still gives your finance team enough breathing room.

This is getting much faster with modern tools. The expense management market, which hit $7.12 billion in 2023, is booming for this very reason. With 47% of employees reporting reimbursement delays, businesses are turning to automated systems that are cutting processing times by a massive 60%. This tech trend is quickly reshaping what employees expect from a policy.

Communicating your timeline and, more importantly, sticking to it is one of the best ways to build trust and show your team you value them.

Navigating Tax Rules and Legal Requirements

Getting your employee expense policy right is about more than just managing your budget—it's a critical legal and financial function. If you get it wrong, you can create a huge tax mess for both your company and your people. The key to staying out of trouble is understanding how the IRS looks at expense reimbursements.

At the center of it all is a concept called an "accountable plan." This is the IRS's official framework that determines whether the money you give back to employees is a tax-free reimbursement or just extra taxable income. If your policy doesn't meet their criteria, every dollar you reimburse is treated as wages, and you'll be on the hook for income and payroll taxes on it.

The Three Pillars of an Accountable Plan

For a reimbursement to be considered tax-free, your policy has to be built on three non-negotiable pillars. If even one of them is shaky, the whole thing can come crashing down during an audit.

Here’s what the IRS insists on:

- A Clear Business Connection: Every expense has to be directly tied to your business. An employee can’t get reimbursed for a personal dinner, even if it happens during a business trip. It must be a legitimate cost of doing their job.

- Adequate Substantiation: This is all about proof. Employees need to submit detailed, itemized receipts and explain the business purpose behind the spending. They have to do this in a reasonable amount of time, too—within 60 days is a good rule of thumb. A simple credit card statement showing a total charge just won't cut it.

- Return of Excess Funds: Did you give an employee a cash advance for a trip? They have to return any money they didn't spend. If they pocket the extra cash, the entire reimbursement for that trip can become taxable. The deadline for returning funds is also pretty generous, usually around 120 days.

Following the accountable plan rules isn't just about dodging taxes. It creates financial discipline and ensures that every dollar spent is documented, justified, and actually contributes to the business.

State Laws and Remote Work Considerations

Don't forget that the IRS isn't the only rule-maker here. A growing number of states have their own specific laws that force employers to reimburse necessary business expenses. States like California and Illinois, for example, are very clear: employers must cover all reasonable and necessary costs an employee has to pay to do their job.

This has become a huge deal with the explosion of remote work. In those states, a portion of an employee's home internet or personal cell phone bill can easily be considered a mandatory business expense. It’s absolutely essential to know the laws in every single state where you have employees. Ignoring them is a quick way to get hit with penalties and lawsuits.

Record-Keeping and Audit Preparedness

Good records are your best friend in an audit. The IRS requires you to keep employment tax records for at least four years, but honestly, holding onto expense-related documents for seven years is a much safer bet.

Your system for storing these records needs to be organized and easy to search. Make sure you're keeping:

- Digital or original copies of all itemized receipts.

- The completed expense report forms, along with proof of manager approval.

- Any other paperwork that proves the business purpose, like meeting agendas or client lists.

Mismanaging reimbursements can seriously ding your bottom line. As of December 2023, employer compensation costs hit an average of $43.11 per hour. Of that, benefits—which include reimbursements—accounted for $12.77. A poorly managed or non-compliant policy can bloat that number, turning a routine process into a major financial leak. You can dig into more of these compensation breakdowns from the U.S. Bureau of Labor Statistics.

Handling Independent Contractors and Freelancers

The rules change completely when you're working with independent contractors. You don't typically reimburse their expenses the way you do for employees. A freelancer’s costs for things like software, travel, or supplies are considered their own business overhead.

They usually bake these costs into their project rate or overall fee. To keep the line between contractor and employee crystal clear (and avoid misclassification trouble with the IRS), always pay contractors their agreed-upon rate based on an invoice. You should never set up a formal expense reimbursement process for them—it starts to make them look like an employee, which can open a huge can of legal and tax worms.

Let's Be Honest: Paper Receipts Are a Nightmare

Solid documentation is the foundation of any good expense policy. We all know this. But let's be real—managing a tidal wave of paper receipts is a fast track to headaches and wasted time. Hunting down lost slips of paper, squinting at faded ink, and manually punching numbers into a spreadsheet? It's an administrative black hole.

The secret to a system that actually works is to ditch the paper chase and embrace the tools we all have in our pockets.

Encouraging your team to snap a quick photo of their receipts right away is a game-changer. It instantly solves the age-old "I lost the receipt" problem. These digital copies are a breeze to organize, search, and attach to expense reports, creating a clean, audit-ready trail from the moment the purchase is made.

Think about it from a manager's perspective. When an expense report lands on their desk with clear, legible digital receipts attached, they can approve it in seconds. No more back-and-forth emails trying to decipher a crumpled, coffee-stained piece of paper. The entire process just flows.

But What About When Receipts Genuinely Disappear?

Even with the best intentions, receipts get lost. It happens. A crucial invoice for a software subscription gets buried in an inbox, or the receipt from that important client dinner vanishes into thin air. In the old days, this often meant the employee was simply out of luck, which breeds resentment and feels deeply unfair.

This is exactly where a tool like Receipt Maker can save the day. It allows an employee to accurately recreate a record for a legitimate business expense when the original is gone for good. Let's be clear: this isn't about inventing expenses. It's about generating the proper documentation for valid claims that would otherwise get stuck in limbo over a technicality.

By using a tool like this responsibly, you create a practical safety net. It bridges the gap between strict policy rules and the messy reality of daily business, ensuring your team gets reimbursed for legitimate costs without you having to compromise on your documentation standards. Your policy should absolutely outline how and when such a tool can be used—I typically recommend requiring a signed affidavit from the employee confirming the expense is real.

Simple Habits for Taming Digital Clutter

Going digital is the first step, but you also need a system. Otherwise, you’re just trading a shoebox full of paper for a chaotic folder of randomly named JPEGs. A little organization goes a long way.

Here are a few tips I've seen work wonders:

- Create a Naming Convention: This is non-negotiable. A simple, consistent format like

YYYY-MM-DD_Vendor_Amount(e.g., 2024-10-26_ClientDinner_112.75.pdf) makes finding anything a snap. - Use a Shared Cloud Folder: Store all receipts and expense reports in a secure cloud drive like Google Drive or Dropbox. This gives everyone who needs it—the employee, their manager, and the finance team—instant access from anywhere.

- Let Software Do the Heavy Lifting: Most modern expense apps can automatically scan receipts, pull out the key data (vendor, date, amount), and even categorize the spending. This massively cuts down on manual entry and the inevitable human errors that come with it.

A well-organized digital system is your best defense in an audit. It demonstrates a commitment to compliance and makes it simple to pull up any necessary documentation on a moment's notice, reinforcing the integrity of your entire employee expense reimbursement policy.

Ultimately, leaning into modern tools makes life easier for your team and your finance department. If you want to dig deeper into creating a bulletproof system, check out our guide on how to organize receipts for taxes at https://receiptmakr.com/blog/how-to-organize-receipts-for-taxes, which offers even more practical strategies.

Common Expense Policy Questions (And How to Answer Them)

Even the most buttoned-up expense policy will have gray areas. Inevitably, unique situations will pop up, and your team will have questions. Getting ahead of these common curveballs saves everyone—especially your finance team—a ton of headaches and ensures the rules are applied fairly across the board.

Let's walk through some of the most frequent questions that come up and give you some clear, practical answers to keep things moving.

"I Had to Use My Personal Card for a Business Expense. How Do I Get Reimbursed?"

This happens all the time. When an employee pays for a work expense out of their own pocket, the process should be exactly the same as any other claim. They'll need to submit an itemized receipt and a completed expense report, just as if they'd paid with cash.

The key here is to be crystal clear in your policy: reimbursement is strictly for the cost of the expense itself. Make it known that you won't cover any personal credit card interest, late fees, or rewards points they might have earned. The best way to build goodwill is to reimburse your people fast. No one wants to carry company debt on their personal card for weeks on end.

"What Kind of Home Office Expenses Can I Claim as a Remote Employee?"

With a distributed team, you absolutely have to define what counts as a reimbursable home office expense. A vague "WFH stipend" can actually put your accountable plan at risk with the IRS, so specificity is your friend.

Most companies cover things like:

- Essential Office Supplies: Think printer paper, ink, pens, and notebooks—the basic tools needed to do the job.

- A Slice of the Internet Bill: A reasonable, pre-defined percentage that reflects business use.

- Specific Software: Any subscriptions for tools that have been approved for their role.

Set clear spending caps for each category and demand the same proof of purchase you would for any other business expense. And remember, this isn't just about being nice. Several states, including California and Illinois, legally require employers to reimburse necessary work-from-home expenses.

"I Can't Find My Receipt. What Do I Do?"

Let's be real—receipts get lost. It's a fact of business life. Your policy needs a clear game plan for when this happens.

The standard procedure is to have the employee fill out a "lost receipt affidavit" or a similar form. This document forces them to formally attest to the details of the purchase, including:

- The vendor's name

- The exact date of the transaction

- The total amount paid

- The specific business purpose

Many companies are fine with this for smaller amounts, say, anything under $25. For larger expenses, you might want to require a manager's signature. This is also a perfect scenario where a tool can help create a legitimate substitute record, allowing an employee to accurately document a real expense when the original slip of paper is gone for good.

An annual policy review isn't just a "nice-to-have" administrative task. It's an essential health check that ensures your expense guidelines remain fair, compliant, and aligned with your company's evolving needs and financial realities.

"How Often Should We Be Updating Our Policy?"

Think of your expense policy as a living document, not something you write once and forget. You should plan to give it a thorough review at least once a year.

Beyond that, you'll want to revisit the policy whenever there's a major shift in the business. Are people traveling differently? Did you just expand into a new state with its own set of rules? Did the IRS change its per diem rates? These are all triggers for a review. Regular check-ins keep your policy relevant and give you a chance to listen to feedback from your team to make the whole process better.

Dealing with lost receipts and messy documentation can bring your whole reimbursement process to a halt. With Receipt Maker, you can create professional, accurate records for legitimate business expenses when the original copies have vanished. This helps your team get paid back quickly without bending your policy's rules. Generate a receipt in seconds with Receipt Maker.