A Practical Guide on How to Manage Small Business Finances

Learn how to manage small business finances with our guide. We cover actionable steps for budgeting, cash flow, and tax prep to secure your business's future.

Before you can even think about profit margins or growth strategies, you have to get the basics right. Managing your business's money isn't just a chore; it’s the bedrock of your entire operation. It all starts with drawing a clear line in the sand between your personal and business finances and then figuring out exactly where you want to go.

This foundational work saves you from massive headaches come tax time and gives you a real, actionable roadmap for growth.

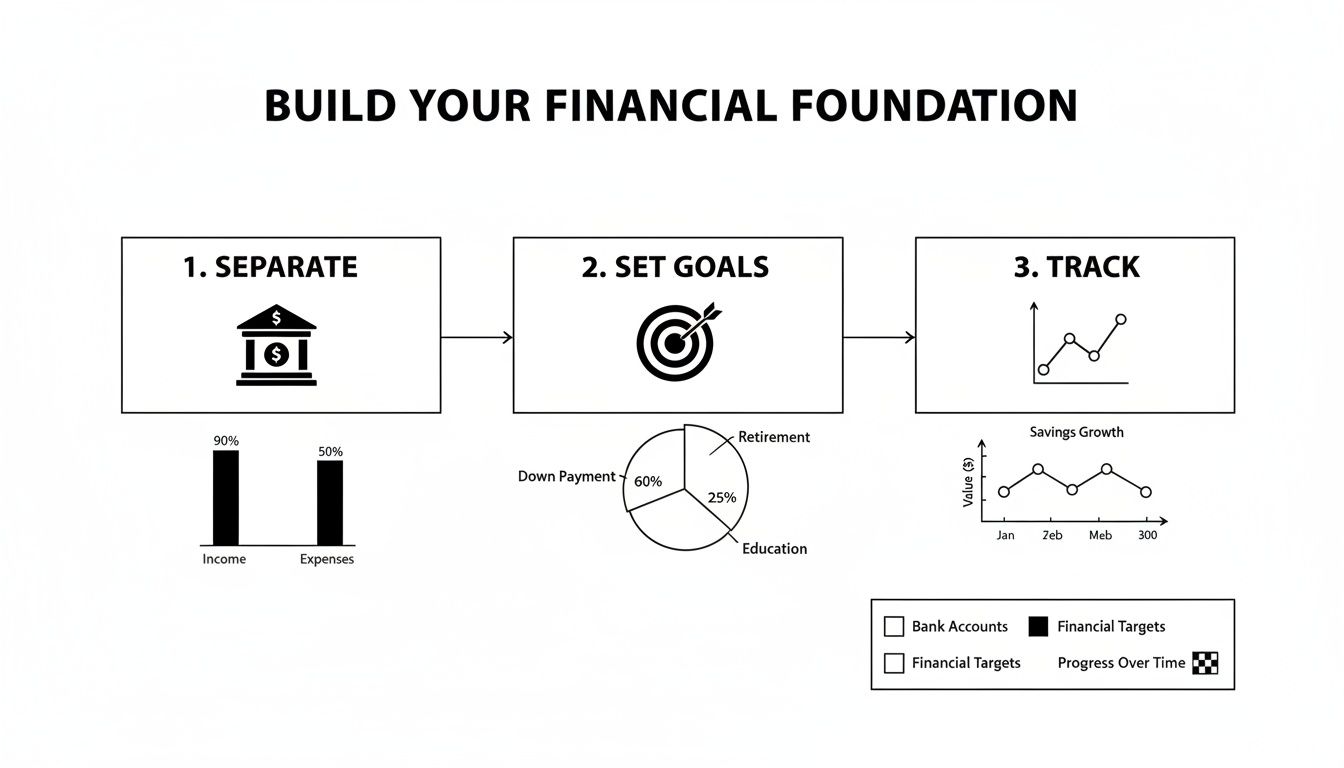

Building Your Financial Foundation

Look, before you jump into fancy accounting software or complex spreadsheets, you need to lay a solid groundwork. This isn't about becoming a CPA overnight. It’s about putting a few core habits in place that bring clarity, keep you on the right side of the law, and pave the way for a business that can actually last.

It's a common story: a brilliant baker or a genius coder starts a business but feels completely lost when it comes to the numbers. You're not alone if you feel that way. A recent survey found that only 54% of owners felt confident in their financial management skills when they first started. You can dig into more data on how financial literacy impacts small businesses to see just how widespread this is.

Separate Your Business and Personal Finances

The very first, most critical thing you need to do is separate your business and personal money. It sounds almost too simple, but it’s an absolute must for any serious business owner.

Mixing your funds—like buying office supplies with your personal debit card or tossing a client check into your personal savings—creates a massive mess for bookkeeping. Worse, it can put your personal assets, like your home or car, at risk if your business ever faces legal trouble.

The bedrock of smart financial management is a dedicated business bank account and credit card. It simplifies everything, offers legal protection, and gives you a clear, honest look at how your company is actually doing.

Imagine a freelance photographer using their personal checking account for everything. When tax season rolls around, they're stuck digging through a year of bank statements, trying to remember if that Amazon purchase was for a new lens or a birthday gift. It’s a chaotic, stressful, and completely avoidable situation.

Set Specific and Measurable Financial Goals

Once your accounts are separate, you need to define what "success" actually means for you in cold, hard numbers. Vague wishes like "I want to be profitable" won't get you anywhere. Real financial goals are specific, measurable, and have a deadline.

This is the essential starting point for building your financial foundation.

As the visual shows, it’s a simple but powerful process: get your accounts in order, set clear targets, and then keep an eye on how you're doing.

For instance, the owner of a small coffee shop might set a goal to increase monthly revenue by 15% within the next six months. This is a target you can work toward. It forces them to think strategically: How will we get there? A new loyalty program? Adding grab-and-go lunch options? A targeted social media campaign?

Here are a few other examples of strong, actionable financial goals:

- Achieve a 20% net profit margin by the end of the fiscal year.

- Cut operating expenses by 10% this quarter by finding a new packaging supplier.

- Build a cash reserve that can cover three months of operating costs within the next 18 months.

Setting these kinds of benchmarks gives your business direction. It turns financial management from a reactive, backward-looking task into a proactive tool you can use to steer your company exactly where you want it to go.

Mastering Your Budget and Cash Flow

With your financial goals pinned down, it's time to get your hands dirty and take control. This is where the real work begins: mastering the two most vital signs of your business's health—your budget and your cash flow. We're not talking about a rigid, set-it-and-forget-it document. The goal here is a living, breathing financial roadmap that guides your daily decisions and turns that lingering financial anxiety into a feeling of empowerment.

If you're feeling the pressure, you're not alone. For so many entrepreneurs, managing money feels like a constant tightrope walk. In fact, 51% of owners point to cash flow as one of their top three financial headaches, and a staggering 56% of small businesses end up seeking funding just to cover day-to-day operating costs. You can dig into more of these common small business challenges to see just how common this is.

Crafting a Dynamic Business Budget

Let's clear something up: a business budget isn't a financial straitjacket. Think of it more like a GPS, helping you allocate your resources wisely to get to the destination you've already set. A solid budget gives you a crystal-clear picture of your income versus your expenses, which is the first step to making smarter spending decisions.

Start by mapping out all your expected income for a set period—say, a month or a quarter. Next, you'll want to break down all your expenses into two simple buckets:

- Fixed Costs: These are the predictable bills that show up every month, no matter how much you sell. We're talking about rent, insurance, salaries, and those software subscriptions you can't live without.

- Variable Costs: These are the expenses that go up or down with your business activity. Think raw materials for your products, shipping costs, or paying freelance help during a busy season.

Sorting your spending this way immediately shows you where your money is really going. It's an eye-opening exercise that lets you spot opportunities to trim the fat without hurting your business. The trick is to treat it as a living document. Review it monthly, at a minimum, and tweak it as things change.

A budget is not just an accounting tool; it's a strategic document. It translates your business goals into a financial plan, ensuring every dollar you spend is working toward your long-term vision.

Proactively Managing Your Cash Flow

Here’s a hard truth: you can be profitable on paper and still go out of business. That’s because cash flow—the actual money moving in and out of your bank account—is king. Managing it is arguably the single most important financial task you have as an owner.

The first move is to create a cash flow forecast. This is simply your best guess at the cash coming in and going out over a specific period, often the next 13 weeks. This forecast is your early-warning system, helping you spot potential cash shortages before they turn into full-blown crises.

Your forecast needs just three core components:

- Beginning Cash Balance: What’s in the bank at the start of the period.

- Cash Inflows: All the cash you expect to receive, from customer payments to loan funds.

- Cash Outflows: All the payments you expect to make, like payroll, rent, supplier invoices, and loan repayments.

When you track this, you'll know exactly when you might hit a tight spot, giving you precious time to react.

Strategies for Improving Your Cash Position

Once you have a good handle on your cash flow forecast, you can start making moves to improve it. You'd be surprised how small, strategic tweaks can make a massive difference to your liquidity.

Imagine a freelance graphic designer who always invoices clients on "Net 30" terms. If a big client pays late, that designer might have trouble covering their own rent. To get ahead of this, they could:

- Offer an early payment discount: A small incentive, like 2% off for paying within 10 days, works wonders for getting clients to pay up faster.

- Request a deposit: Asking for 50% upfront is standard in many industries and guarantees you have some cash flow before the work even starts.

You can also work the other side of the equation by managing your own payments. See if you can negotiate longer payment terms with your key suppliers. If you normally pay an invoice in 30 days, asking for 60-day terms can keep cash in your business for an entire extra month. For a deep dive into the nuts and bolts of this, check out this guide on how to track business expenses properly.

Mastering these cash flow techniques is fundamental to building a business that can weather any storm. To help, here are a few essential strategies to keep in your back pocket.

Essential Cash Flow Management Techniques

| Strategy | Actionable Tip | Why It Matters |

|---|---|---|

| Speed Up Invoicing | Send invoices immediately after delivering a product or service. Use online invoicing tools with payment links. | The sooner you invoice, the sooner you get paid. Delays in invoicing directly cause delays in cash inflow. |

| Incentivize Early Payments | Offer a small discount (e.g., 2% off) for payments made within 10 days (2/10 Net 30). | This encourages clients to prioritize your invoice, accelerating your cash cycle and improving predictability. |

| Review and Reduce Expenses | Conduct a monthly review of all subscriptions and variable costs. Cut anything that isn't providing a clear ROI. | Every dollar saved is a dollar that stays in your bank account, directly boosting your cash reserves. |

| Manage Inventory Wisely | Use inventory management software to avoid overstocking. Too much cash tied up in inventory is cash you can't use. | This prevents your capital from sitting idle on a shelf and reduces the risk of having to discount old stock. |

| Negotiate Supplier Terms | Ask your key suppliers for longer payment terms (e.g., from Net 30 to Net 60). | This allows you to hold onto your cash longer, giving you more flexibility to cover other operational costs. |

| Establish a Line of Credit | Secure a business line of credit before you need it. | It acts as a crucial safety net for unexpected expenses or slow sales periods, preventing a cash crunch. |

Taking these proactive steps will help you move from simply surviving to truly thriving, giving you the financial stability to focus on what you do best: growing your business.

Nail Down Your Bookkeeping and Record Keeping

Let's be honest: bookkeeping can feel like a chore. But accurate, organized records are the absolute bedrock of a healthy business. They're what give you the clarity to make smart decisions, stay compliant with the IRS, and actually understand where your money is going. Flying blind with your finances is a recipe for disaster.

The good news is that you don't need a degree in accounting to get this right. The goal is to build a simple, consistent system that captures every single transaction. Imagine tax season rolling around and you're not scrambling—because everything is already clean, complete, and up-to-date. That peace of mind is priceless.

Single-Entry vs. Double-Entry: Pick Your Method

First things first, you need to decide how you'll track everything. Your choice really depends on how complex your business is. For most small businesses, it boils down to two options.

- Single-Entry Bookkeeping: This is the most basic approach, a lot like balancing a checkbook. You log money when it comes in and record expenses when they go out. It's often enough for a freelancer or a sole proprietor with very straightforward finances.

- Double-Entry Bookkeeping: This is the grown-up version. Every transaction gets recorded in at least two accounts—as a debit in one and a credit in another. It’s a much more powerful system that gives you a clear view of your assets and liabilities. If you’re incorporated, carry inventory, or have significant loans, this is the way to go.

While single-entry is definitely easier to start with, double-entry is the gold standard for a reason. It has a built-in error-checking system and provides the data you need for proper financial statements. If you have any plans to grow, I'd strongly recommend starting with a double-entry system from day one.

Create a Bulletproof System for Receipts

Here’s a hard truth: a lost receipt is lost money. Every expense you can't prove is a tax deduction you can't take, which means you're literally handing over extra cash to the government. A disciplined receipt management system isn't optional.

Your system has to handle everything, from the paper invoice from your supplier to the digital receipt from your latest Facebook ad campaign. They’re all crucial pieces of your financial puzzle.

Here’s a simple workflow you can put into practice today:

- Create a Central Hub: All receipts go to one place. Period. This could be a simple physical folder for paper and a dedicated folder in Google Drive or Dropbox for digital copies.

- Capture It Immediately: Don't let receipts pile up in your wallet or the truck's glove box. Use a scanner app on your phone (like Adobe Scan or even your phone's camera) to digitize paper receipts the moment you get them.

- Organize Logically: Inside your digital hub, create folders by year, then by month, then by expense category (e.g., "2024" > "10-October" > "Supplies"). This structure makes pulling up a specific receipt a 10-second job, not a 10-hour nightmare.

A shoebox full of crumpled receipts isn't just a mess; it's a symptom of a weak financial process. Building a simple, daily habit of capturing and organizing them instills the discipline you need for long-term financial health.

This small bit of daily effort pays off big time. For more great ideas on refining your system, check out these small business bookkeeping tips to help you stay organized and audit-proof.

The Power of Regular Reconciliation

Bookkeeping isn't a "set it and forget it" task. The final, critical piece of the puzzle is reconciliation. All this means is matching the transactions in your books to your actual bank and credit card statements.

You absolutely have to do this at least once a month. It’s how you catch bank errors, spot fraudulent charges, and make sure your own records are 100% accurate. This process confirms that the financial picture you’re looking at is reality, not just wishful thinking.

Think of it as your final quality check. Without it, you could be making major business decisions based on bad numbers, leading to unexpected cash flow problems or a nasty surprise from the IRS. Consistent reconciliation gives you the confidence to lead your business forward, knowing your numbers are solid.

Choosing the Right Financial Tools and Software

Let's be honest. The old shoebox full of receipts and a clunky spreadsheet might feel simple at first, but it's a recipe for disaster. Before you know it, you're drowning in manual data entry, making costly mistakes, and have absolutely no real-time clue how your business is actually doing. Investing in the right technology isn't an expense—it's one of the smartest moves you can make for your company's health and your own sanity.

Building a solid financial "tech stack" isn't about finding one perfect app to rule them all. It's about picking a strong central accounting platform and then surrounding it with specialized tools for things like invoicing, tracking expenses, or processing payments. When these systems all talk to each other, you create a smooth, automated workflow that frees up your time and gives you a truly clear picture of your finances.

Selecting Your Core Accounting Platform

Think of your accounting software as the brain of your entire financial operation. It’s the central hub where every transaction lands, gets categorized, and is ultimately transformed into the financial reports you rely on to make smart decisions.

The market is crowded, but a few names consistently rise to the top for small businesses. Choosing the right one really boils down to your specific business model, your budget, and how complex your needs are. A freelance designer just doesn't need the same features as a growing e-commerce shop managing inventory.

To help you get started, here's a look at some of the most popular options out there.

Comparison of Top Small Business Accounting Software

| Software | Best For | Key Feature | Price Point |

|---|---|---|---|

| QuickBooks Online | Established businesses, retail, and anyone needing robust reporting and payroll integration. | The industry standard with a massive feature set and a huge network of certified accountants. | $$ - $$$ |

| Xero | Service-based businesses, consultants, and teams who value a clean interface and unlimited users. | Fantastic bank reconciliation and a very intuitive mobile app for working on the go. | $$ - $$$ |

| Wave | Freelancers, solopreneurs, and micro-businesses who just need the basics without the cost. | Core accounting and invoicing features are genuinely free. | $ (Free Tier) |

This isn't a decision to rush. Switching your financial data from one platform to another is a serious headache, so it pays to choose a solution that has room to grow with you over the next few years.

Essential Tools to Build Out Your System

Once you've got your accounting hub, a few other tools can make a massive difference in your day-to-day efficiency. These apps handle very specific jobs and, most importantly, integrate with your main platform to keep everything in sync automatically. This is where you start to really claw back your time.

Most of these helpful tools fall into a few key categories:

- Expense Tracking Apps: Forget saving paper receipts. Tools like Dext or Expensify let you snap a picture with your phone, and they digitize everything for you. It's a game-changer.

- Invoicing and Payment Processors: While most accounting software has invoicing, dedicated platforms like Stripe or Square often provide a much smoother payment experience for your customers and offer more flexibility.

- Payroll Services: Don't mess around with payroll taxes yourself. A service like Gusto or Rippling automates payroll, tax filings, and benefits, keeping you compliant and your team happy.

The magic word here is integration. Before you sign up for any new tool, double-check that it connects seamlessly with your accounting software. You want a system where a paid Stripe invoice automatically shows up as a reconciled transaction in your Xero account without you lifting a finger.

Your financial tech stack should run like a well-oiled machine. Each part does its job perfectly and passes the information along to the next without you having to manually intervene. That’s how you go from just recording financial history to getting real-time intelligence to run your business.

A Quick Checklist for Making the Right Choice

It's easy to get overwhelmed by feature lists and clever marketing. As you're looking at different options, use this simple checklist to keep you grounded in what actually matters for your business.

- Does it solve your biggest headache? Pinpoint your single greatest financial pain point. Is it chasing down late payments? Tracking project expenses? Find the software that crushes that problem first.

- Can it grow with you? The free app that's perfect today might be a nightmare when you have three employees. Think about where you want to be in one to three years and pick a tool that can get you there.

- How's the customer support? When something inevitably goes wrong on a Sunday night, can you get help? Read recent reviews specifically mentioning customer support—it matters more than you think.

- Is it actually easy to use? If you dread opening the software because it’s clunky and confusing, you won't use it consistently. Always take advantage of free trials to see if the workflow feels natural to you before you commit your credit card.

Taking the time to choose your financial tools wisely today will save you countless hours and dollars down the road, giving you the clarity and freedom to focus on what you do best: running your business.

Navigating Taxes and Managing Debt Strategically

For most small business owners, just hearing the words "tax" and "debt" can cause a spike in blood pressure. But here’s the thing: learning to handle them isn't just about dodging trouble. It's about unlocking real opportunities for growth. When you get this right, you stay compliant, shrink your tax bill, and can even use debt as a smart tool to scale your operations.

This isn't about avoiding penalties—it's about turning a burden into a core part of your financial strategy. It’s how you gain more control over where your business is headed.

Demystifying Your Business Tax Obligations

Tax season shouldn't feel like a mad dash to the finish line. If you prepare throughout the year, it becomes a predictable, manageable part of your routine. The first step is getting a crystal-clear picture of what you actually owe, which all comes down to your business structure and where you operate.

It's almost never just about income tax. Most businesses are juggling a few different things:

- Sales Tax: If you sell taxable products or services, you’re on the hook for collecting this from customers and sending it to the state. The rules and rates can be wildly different from one town to the next, so you have to know your local requirements.

- Payroll Taxes: Got employees? Then you’re withholding federal and state income taxes, plus Social Security and Medicare (FICA) taxes, from every paycheck. On top of that, you’re paying an employer’s share, too.

- Estimated Taxes: Unlike a regular W-2 employee, most business owners pay their income taxes in four quarterly installments. Forgetting one of these can lead to a nasty surprise come April.

The secret to managing all this without tearing your hair out? Organized records. A clean, up-to-date bookkeeping system makes calculating and filing these taxes a simple task instead of an annual nightmare.

Maximizing Your Tax Deductions

Every legitimate business expense you forget to claim is you voluntarily overpaying the IRS. Think about that for a second. Diligent record-keeping is your best defense, letting you capture every possible deduction, lower your taxable income, and keep more of your hard-earned cash where it belongs: in your business.

So many owners miss out on common but valuable write-offs. We all remember to deduct inventory and rent, but what about the less obvious stuff?

Are you deducting:

- A portion of your home office expenses?

- Vehicle mileage for business trips?

- Fees for continuing education or industry conferences?

- All those software subscriptions and professional services?

A receipt isn't just a flimsy piece of paper; it's proof of a tax-deductible expense. Start treating every single one like cash. A bulletproof system for capturing and organizing them is non-negotiable for any financially savvy business.

This is where a little discipline with your records pays massive dividends. For a detailed walkthrough, check out our guide on how to organize receipts for taxes. It’s packed with actionable steps to make sure you’re audit-proof and fully optimized.

Managing Debt as a Strategic Tool

Debt gets a bad rap, but not all debt is the same. The real key is knowing the difference between "good" debt and "bad" debt. Bad debt is what you use for things that lose value or get consumed. Good debt, on the other hand, is an investment in assets that will make you more money down the road—think new equipment that boosts production or a marketing campaign with a proven ROI.

The problem is, debt can be a silent killer. Nearly 40% of small businesses are carrying over $100,000 in loans. What's truly shocking is that 56% of those who sought financing weren't even using it for growth; they were just trying to cover basic operating costs. You can find more details in this small business credit survey.

Auditing Your Liabilities for Financial Health

You can't manage what you don't measure. To get a handle on your debt, you need a perfectly clear picture of what you owe. Start by doing a quick debt audit.

Just make a simple list of all your business liabilities—credit cards, lines of credit, term loans, everything.

For each one, write down:

- The total amount you still owe.

- The interest rate you're paying.

- The minimum monthly payment.

This simple exercise brings so much clarity. It instantly shows you your total debt load and, more importantly, flags any high-interest debts that are quietly draining your cash flow. Once you have this info, you can build a smart repayment plan, like the "avalanche method," where you attack the loan with the highest interest rate first to save the most money over time.

Keeping a close eye on your debt-to-income ratio is also a great habit. This single number tells you whether you're over-leveraged and helps you maintain a healthy financial position that supports, rather than suffocates, your company’s growth.

Common Questions About Small Business Finances

Even with the best system in place, managing your company's money will inevitably bring up questions. That's just part of the journey. Getting straightforward answers is what builds your confidence and keeps you moving forward.

Let's cut through the noise and tackle some of the most common questions I hear from small business owners. Think of this as your go-to resource for when you need a clear answer, fast.

How Often Should I Be Looking at My Finances?

This is a great question, and the answer isn't "all the time." The trick is to create a rhythm—a set of habits that keep you informed without turning into a full-time job.

Here's a cadence that works for most businesses:

- Daily (5 minutes): A quick glance at your business bank account. Is the balance what you expect? Any weird charges? This simple check-in prevents surprises and helps you catch fraud early.

- Weekly (30 minutes): This is your cash flow check-up. Pull up your forecast and compare it to what actually happened. Are clients paying on time? Any big bills coming due that you need to plan for? This is how you stay ahead of cash crunches.

- Monthly (1-2 hours): Time for a proper review. This is when you dig into your three key financial reports: the Profit and Loss (P&L), Balance Sheet, and Cash Flow Statement. How did you do against your budget? What stories are the numbers telling you? This is where you find the insights to make smarter decisions next month.

Quarterly and annual reviews are more about big-picture strategy and tax planning, and you'll likely do those with your accountant. But that monthly deep dive? That’s your secret weapon for staying in control.

When Is It Time to Hire an Accountant or Bookkeeper?

Most of us start out doing our own books. It saves cash and seems manageable at first. But knowing when to pass the baton is one of the smartest decisions you can make.

You should think about hiring a bookkeeper when you’re spending more than a few hours a month just categorizing transactions and reconciling accounts. Their job is to handle the day-to-day data entry, keeping your records spotless. This frees you up to, you know, actually run your business.

An accountant, on the other hand, is your financial strategist. It’s a good idea to chat with one right from the start to get advice on your business structure. As you grow, they become your go-to pro for tax strategy, financial forecasting, and navigating major decisions like taking out a loan.

A good accountant or bookkeeper isn't just an expense; they're an investment. They often save you more money in taxes and costly mistakes than their fees, all while buying back your most valuable asset: your time.

What Are the Most Important Financial Reports I Need to Understand?

You don't need a degree in finance, but you do need to get comfortable with three specific reports. These are the vital signs of your business.

- Profit and Loss (P&L) Statement: Sometimes called an income statement, this report totals up your revenue and subtracts your expenses over a set period, like a month or a quarter. It answers one simple question: "Did we make money?"

- Balance Sheet: This is a snapshot in time. It shows what your company owns (assets), what it owes (liabilities), and the difference between them (equity). It answers the question: "What is our company's net worth right now?"

- Cash Flow Statement: This one might be the most critical of all for a small business. It shows exactly how cash moved into and out of your business. Profit is great, but cash pays the bills. This report answers: "Do we have enough cash to operate?"

Get a handle on these three, and you'll have a surprisingly complete picture of your business's health.

What's the Single Biggest Financial Mistake to Avoid?

If I could only give one piece of advice, it would be this: Do not mix your personal and business finances. It’s the most common and destructive mistake a new business owner can make.

Using your personal checking account for business expenses or paying a personal bill from the business account creates an absolute mess. It makes it nearly impossible to know if you're actually profitable, and you'll almost certainly miss out on valuable tax deductions.

Worse, it can "pierce the corporate veil." That’s a legal term meaning that if your business gets sued or can't pay its debts, your personal assets—your house, your car, your savings—could be on the line.

The fix is simple. Open a dedicated business bank account and get a business credit card on day one. It's a non-negotiable step that separates the hobby from the serious business.

At Receipt Maker, we know that keeping track of every receipt is a core part of good financial hygiene. Our tool makes it easy to create professional, accurate receipts for all your transactions, ensuring your records are always organized and ready for tax time. Try it for free and see how simple it is to keep your bookkeeping clean.